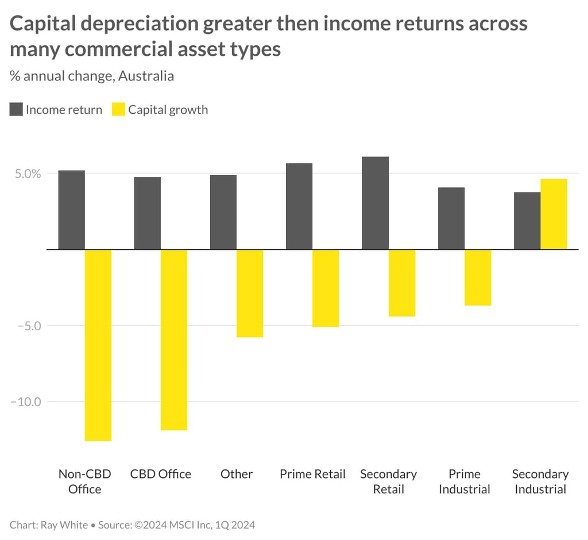

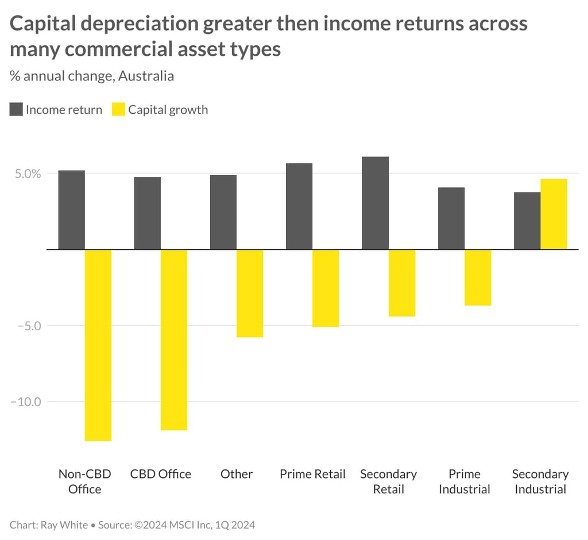

Capital growth is in negative territory for nearly all asset types and locations across the country as the revaluation of assets puts the spotlight on cost of financing, returns and the rapid escalation of prices over the last few years. Risk premiums have re-emerged for most properties as bond rates move ahead of many yields achieved for commercial assets particularly during the 2021/22 period. Despite heavy losses in capital growth, encouragingly, income returns continue to maintain, resulting in total returns for some asset types remaining in positive territory.

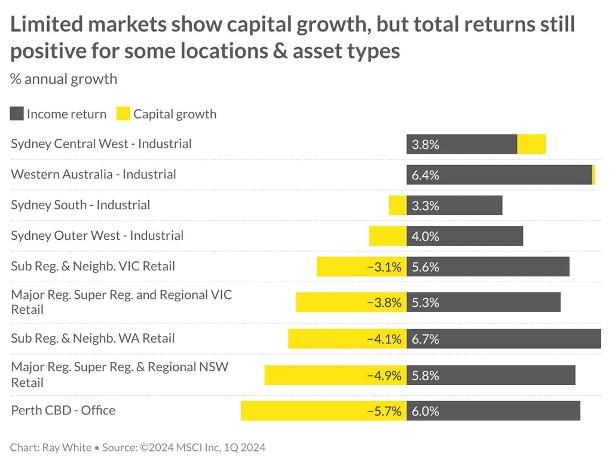

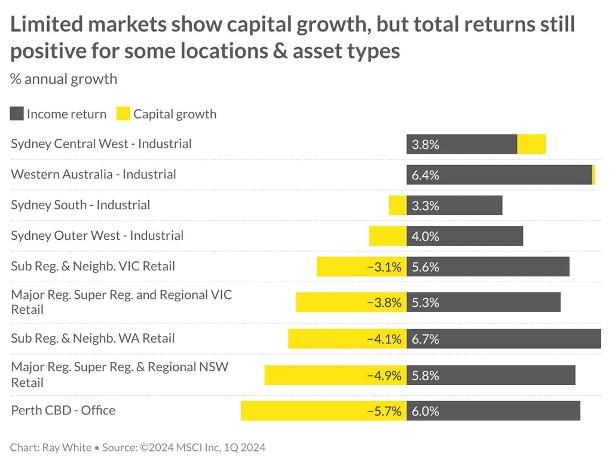

The office market has felt the brunt of these losses, with both non-CBD and CBD office markets recording -12.6 per cent and -11.9 per cent capital losses respectively over the past year. However, looking city-by-city there is still some positivity around. Perth CBD remains the stand out office performer this period, despite capital growth recorded at -5.7 per cent, income returns of six per cent offset this keeping total returns in positive territory, notably in the Premium and A-grade sector.

For the retail sector, total returns show greater optimism. There has been a flurry of shopping centre transactions so far this year, testament to increased confidence in this sector. However, there is no doubt these corrections have spurred on spending with capital declines recorded across all retail types in all locations. Although, strong income growth has resulted in uplifted total returns for some assets. Overall secondary retail has outperformed with total returns of 1.5 per cent (thanks to 6.1 per cent income growth), while prime retail achieved 0.3 per cent.

Looking more locally, strong income improvement for Western Australia and Victorian neighbourhood and sub-regional centres resulted in total returns both at 2.4 per cent. Victoria outperformed again for major, super regional centres recording 5.3 income growth to keep total returns at 1.4 per cent, while New South Wales total returns sat at 0.6 per cent.

However, industrial remains the golden child of the commercial property sector. Limited supply and constrained land saw returns for built form remain elevated. Secondary industrial actually outperformed prime this period with positive capital growth, up 4.6 per cent for a total gain of 8.6 per cent – the most outstanding result of all asset types and locations across the country. Results trended well ahead of the prime market with total returns of just 0.3 per cent. Quality results in warehousing, industrial estates spurred on appreciation in these total returns.

Western Australia led this charge with 6.5 per cent total return (albeit just 0.1 per cent representing capital growth). Total returns for New South Wales hit 2.9 per cent with a small 0.1 per cent capital decline. However looking more locally, Sydney’s Central West has shown outstanding results, recording capital improvements of one per cent this period to grow total returns to 4.9 per cent. Despite Sydney’s Outer West and South still seeing capital declines, total returns remained positive, both at 2.7 per cent. Highlighting pockets of positivity still can be found across the broader commercial property market.

— Vanessa Rader | Head of Research —