Parking in Australia’s CBDs has seen significant changes over the past ten years. Reduced parking allowances for new office and residential development, together with increased levies on spaces in some markets, has put pressure on occupancy, which caused parking rates to increase. Therefore, demand to invest in parking structures was high, although limited stand alone facilities and strata subdivided opportunities were tightly held. Those assets which did come to market achieved rates ranging up to as much as $250,000 per parking space with yields often below bond yields, highlighting the confidence in the sector.

Fast forward to today, and post-pandemic attitudes towards CBD parking have changed. With a workforce still not in the office on a full-time basis, rising fuel costs, together with improvements in public transport across the country, demand to occupy parking spaces has reduced. Last year, Ray White undertook a survey on parking facilities across all CBDs to understand average daily rates and the discounting which is on offer for pre-booked and early bird parkers and how they compared to the results achieved in 2013. While average prices did increase over this ten year period, COVID effects had pressured average rates down and discounting was more prevalent. Furthermore, many operators offer greater flexibility on timed parking to encourage work-from-home staff to visit their CBD offices, even for short periods.

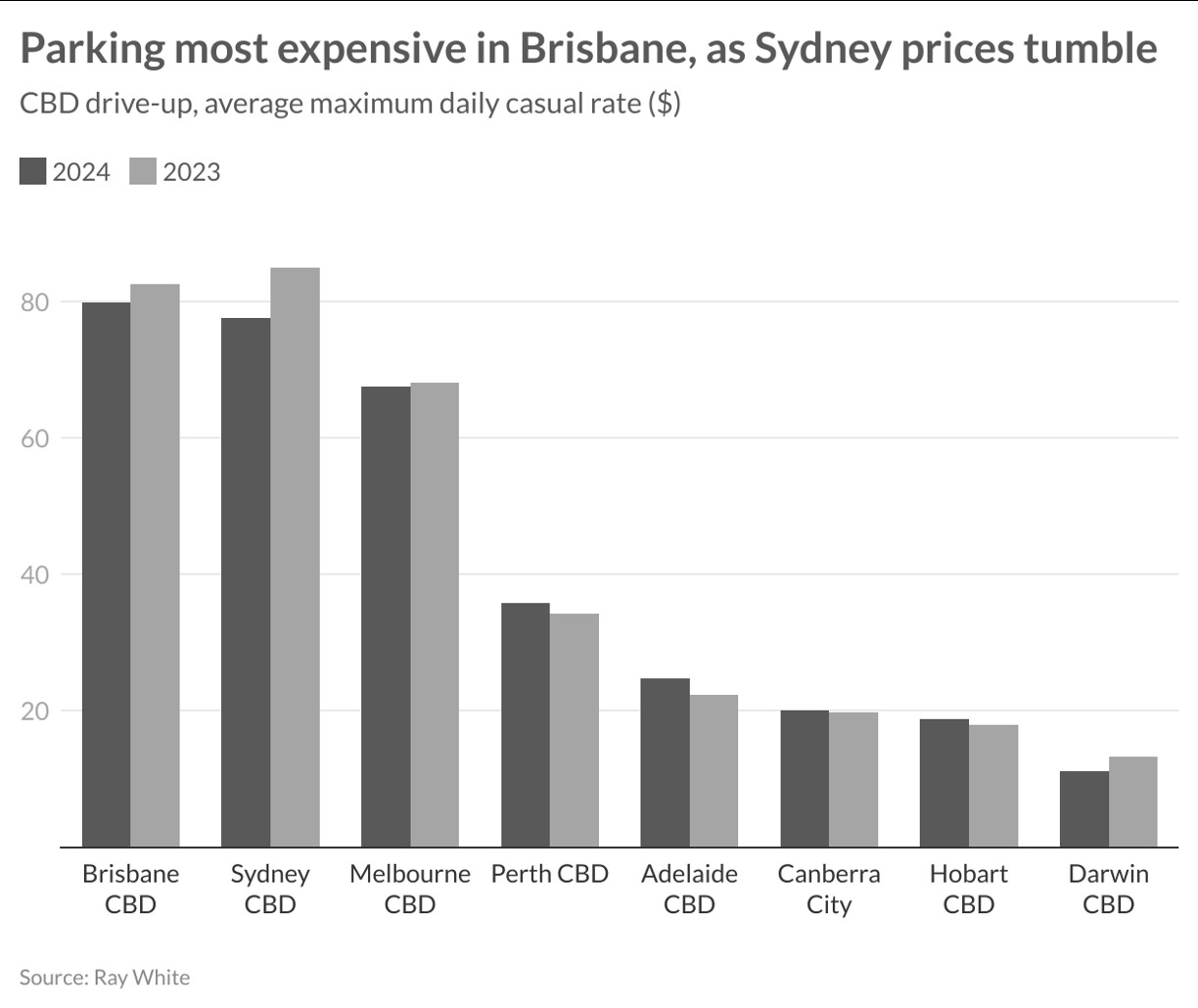

Twelve months on and our recent data has shown more changes in the CBD parking landscape, with major east coast markets recording further discounting to combat vacancies. Based on daily maximum drive up casual rates; Brisbane CBD now dictates the highest prices. Although reducing by 3.4 per cent over the last year, the rate of $79.83/day now bypasses Sydney CBD which has seen an 8.7 per cent fall in average prices to $77.67/day. Despite this current high Brisbane rate, it could be under further occupancy pressures with the Queensland State Government announcing 50 cent public transport costs starting in August which will aid in the cost of living crisis and will generate “car-free” activity back into the CBD. The gap between parking costs and near free public transport is likely too much to be passed up by regular commuters.

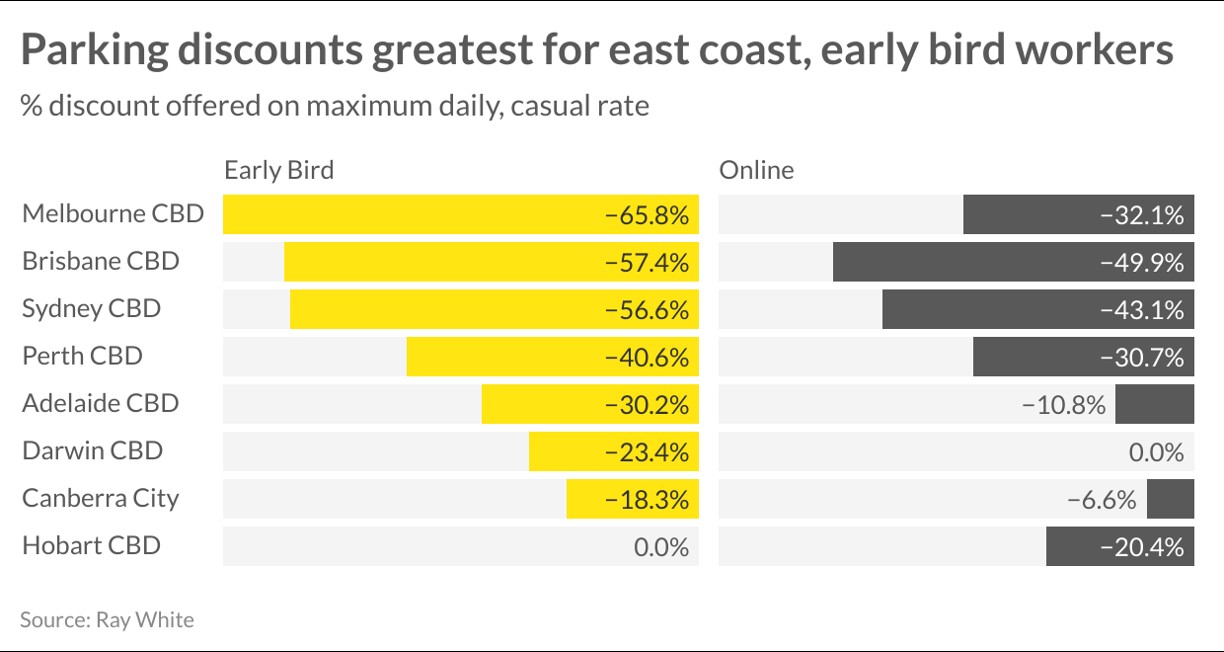

Melbourne CBD parking market has seen the worst longer-term growth of any other region. Over the last year, these daily rates have fallen slightly to $67.49, however, have recorded less than 0.5 per cent annual growth over the past ten years, highlighting the difficulty in CBD office market with long-term high vacancies and a strong WFH movement also affecting the car parking sector. Discounting is also strongest across the Melbourne CBD with early bird rates attracting more than a 65 per cent discount, aimed at the office workforce, this is the highest in the country followed by Brisbane and Sydney.

Away from the east coast markets, parking results have had different fortunes. Despite office vacancies still high in markets such as Adelaide and Perth, average daily parking rates continue to grow. Adelaide recorded the most rapid escalation in costs, up 10.4 per cent over the last year to an average rate of $24.74/day. This market also recorded some of the more limited discounting with online rates attracting a 10.8 per cent reduction, while early bird was down 30.2 per cent on the casual rate. These discounts are indicative of differing attitudes towards public transport and a greater reliance on vehicle transport in the city centre. Similarly, Perth has seen growth over the last year, up 4.3 per cent to $35.77/day, and continues to offer substantial discounts for online and early bird bookings. In Canberra there are limited parking discounts available and daily rates have only seen a small improvement to $20.07, Hobart similarly averaging $18.83/day.

So what do these changing trends mean for the car parking investment market? Transaction levels have been limited across the country over the past few years. Smaller strata title offerings continue to see good results as they are heavily owner occupier driven, however, larger parking structure investment and the reduced returns will likely see values decline. Over the past year, we have seen assets come to market that fail to transact, however, one recent sale in Melbourne’s CBD has set a new benchmark with a price on a per bay basis of just over $30,000, a far cry from values achieved pre-pandemic. For many car park owners, freehold assets still offer long term quality returns and future development potential hence remain tightly held, particularly as our CBDs change; while operators who offer EV charging, easy-to-use apps offering discounts, and easy access will be best rewarded with the best occupancy.

— Vanessa Rader | Head of Research —