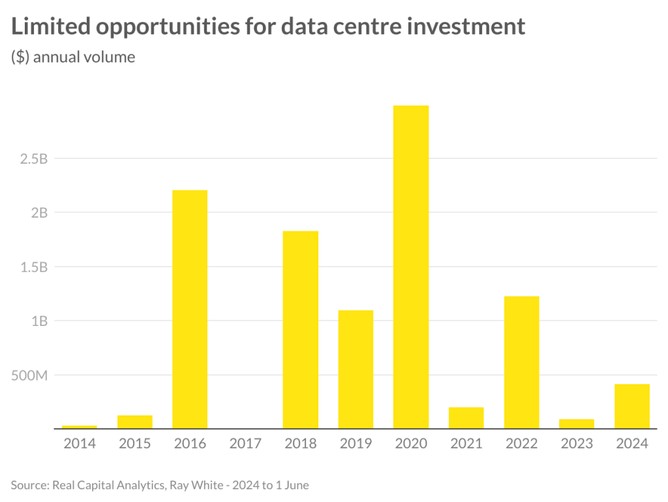

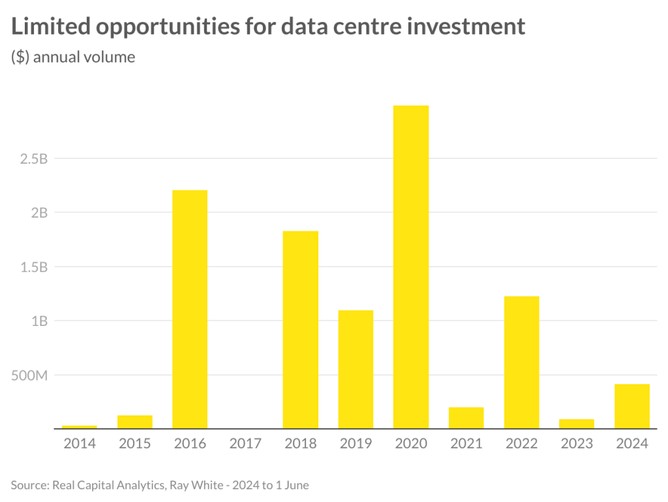

Over the past two decades, the number of data centres around the world has been steadily increasing, with Australia now ranking as the seventh most populous country for these facilities. The nation has witnessed significant investments, totaling more than $13.6 billion, directed towards the construction of new data centres. In the last year alone, completed projects added more than 150,000sqm of space. As the country’s population grows, it is anticipated that the demand for these facilities will also increase, resulting in assets being closely held and low annual sales volumes. In the past 10 years, transactions have been limited, reaching a peak of $3 billion in 2020, with an average investment of approximately $1.2 billion per year. During the first five months of 2024, a range of offerings have been transacted, amounting to $414.5 million.

Historically, the majority of investment activity has been concentrated in the NSW market, primarily in metropolitan areas, followed by Melbourne. Despite Queensland’s strong population growth, there have been limited transactions for data centres in this location, with existing assets being tightly held. On the other hand, opportunities in the ACT,, South Australia, and Western Australia have all made significant progress in terms of transaction volume.

Data centres have proven to be an attractive investment opportunity for larger institutional and offshore investment groups, with the average investment size over the last ten years sitting at $94.5 million, unlike many other alternative asset classes. Historically, foreign investors have been the primary investor type, with the United States and Canada being the major buyers. However, prior to the pandemic, China, Singapore, and New Zealand groups also featured in the market. Although sales volumes have been limited in the last 18 months, there has been a shift in the seller profile, with some offshore groups divesting their assets and local groups now becoming the dominant buyer category. Despite this change, foreign funds continue to be the major players in the development of new data centre space. With more than 140,000sqm currently under construction, approximately 80 per cent is represented by offshore capital, including Microsoft’s Penrith facility, which is set to be completed in early 2025.

During 2023, the energy consumption of these facilities grew by 55 per cent internationally, highlighting the importance of focusing on renewable energy options moving forward. Developers and investors aiming to achieve their internal environmental, social, and governance (ESG) targets are placing a major emphasis on the ability to offset consumption costs, reduce carbon emissions, and maintain quality connectivity.

Moving forward, the development and investment of data centre assets will continue to prioritise these factors, along with efficient mechanical and plumbing systems, such as the use of recycled water. Assets that successfully incorporate these features will likely achieve the most favourable yields. Before the pandemic, yields for data centre assets ranged from 7 to 9.5 per cent. However, during the period of low interest rates, yields compressed to as low as 4.3 per cent. Recent sales have seen yields rumoured to be as low as 3.6 percent and as high as the upper 6 per cent range, varying based on factors such as size, location, and functionality.

As Australia’s population grows and its dependence on technology increases, the country’s demand for data is expected to rise. Consequently, data centres will attract greater attention as an investment class. While foreign investors have been active in this asset class for some time, Australia is emerging as one of the key global locations for new facilities, following countries like the United States, Germany, United Kingdom, and China. The growing demand from the listed sector is expected to put pressure on yields and drive the development of new supply.

Vanessa Rader | Head of Research