The Australian self-storage sector has become a boutique industrial investment opportunity that has largely flown under the institutional radar. While it may lack the scale of distribution centres or data centres, global sector trends suggest this asset class deserves greater attention from sophisticated investors seeking income inflation hedging and defensive yields in an uncertain environment.

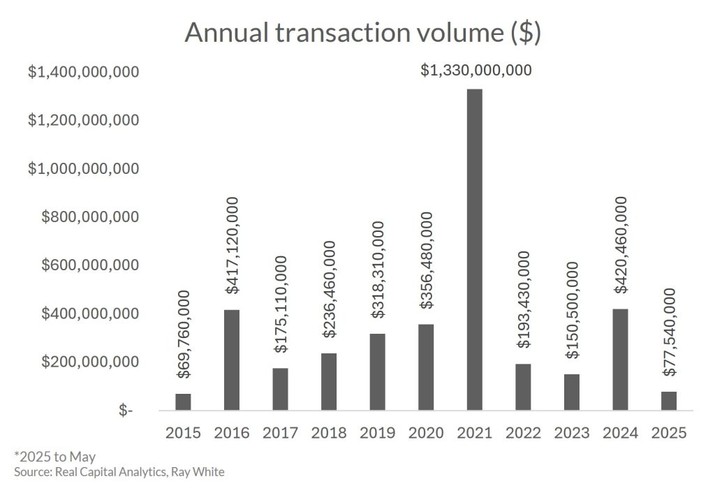

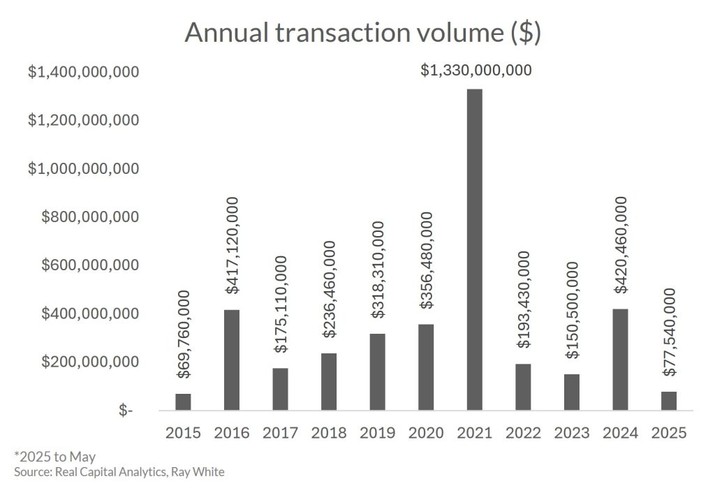

The market’s tightly held nature is evident in transaction patterns spanning the past decade. Annual volumes typically range between $200 and $400 million, with notable exceptions including the extraordinary $1.3 billion transacted in 2021 during the pandemic-driven investment surge, and the sharp contractions to $193 million in 2022 and $150 million in 2023. The 2024 recovery to $420 million suggests renewed confidence, though combined with the first five months of 2025 ($77 million), the past 18 months total just $493 million, demonstrating how illiquid this market can become.

This scale limitation explains why major institutional players remain largely absent, as most funds look at size and returns well beyond what individual self-storage facilities can deliver. However, it creates opportunities for private investors and smaller funds willing to accumulate portfolios. With national occupancy rates hovering near 90 per cent, mirroring global sector trends and representing the optimal balance between revenue maximisation and growth potential, rental growth has accelerated due to housing pressures. These assets are delivering yields between 5 and 6.5 per cent, comparing favourably to traditional industrial assets in the current environment, particularly as operators increasingly adopt sophisticated dynamic pricing strategies and Revenue Per Available Metre (RevPAM) analysis to optimise performance.

Australia’s housing affordability crisis is inadvertently becoming self-storage’s greatest growth driver. As rental costs force downsizing and push residents to outer metropolitan areas, demand for storage solutions grows. This demographic shift is particularly pronounced among Gen-Z renters and baby boomers downsizing their family homes. The generational convergence sees younger demographics storing possessions while navigating volatile rental markets, and older Australians transitioning to smaller homes while maintaining emotional attachments to furniture and heirlooms. This dual demand base provides unusual stability compared to single-demographic asset classes.

For investors, self-storage offers minimal tenant improvements, low maintenance requirements, and multiple revenue streams through insurance, access fees, and ancillary services. The month-to-month lease structure provides inflation protection and operational flexibility unavailable in traditional industrial leases. However, individual facilities rarely exceed $50 million in value, making portfolio assembly time-consuming and expensive. Management intensity however, exceeds that of distribution centres and requires increasingly sophisticated operational capabilities. Successful operators must understand their demographic catchment, implement dynamic pricing systems, and maintain detailed performance metrics that institutional buyers expect. Competition from established operators like Kennards and National Storage can pressure smaller players, while increasing reliance on technology adds to both initial and ongoing costs.

Overall, long run demand drivers remain robust, as urbanisation increases storage needs and changing work patterns drive space consolidation. Investors should focus on growth corridors where demographic trends align with supply constraints, particularly outer metropolitan areas experiencing population growth. With limited new construction in the pipeline, occupancy will continue to improve and rental rates face upward pressure.

For institutional investors, self-storage likely remains a satellite allocation rather than a core holding due to scale limitations and management requirements. However, for private equity groups and smaller institutions willing to aggregate portfolios, the fundamentals suggest attractive risk-adjusted returns over the medium term. The sector’s scarcity is compounded by industrial zoned land commanding premium pricing across the country, making new development increasingly challenging even as demand grows. Assets rarely come to market, and when they do, they often trade within established networks of operators and specialised investors. For prospective buyers, this environment demands sophisticated analysis of catchment demographics and operational metrics. Those who can demonstrate superior market intelligence are likely to command premium valuations, while the ongoing scarcity of quality assets suggests patient capital may be rewarded as the structural demand story continues to unfold.

_______________________________________

Vanessa Radar – Head of Research