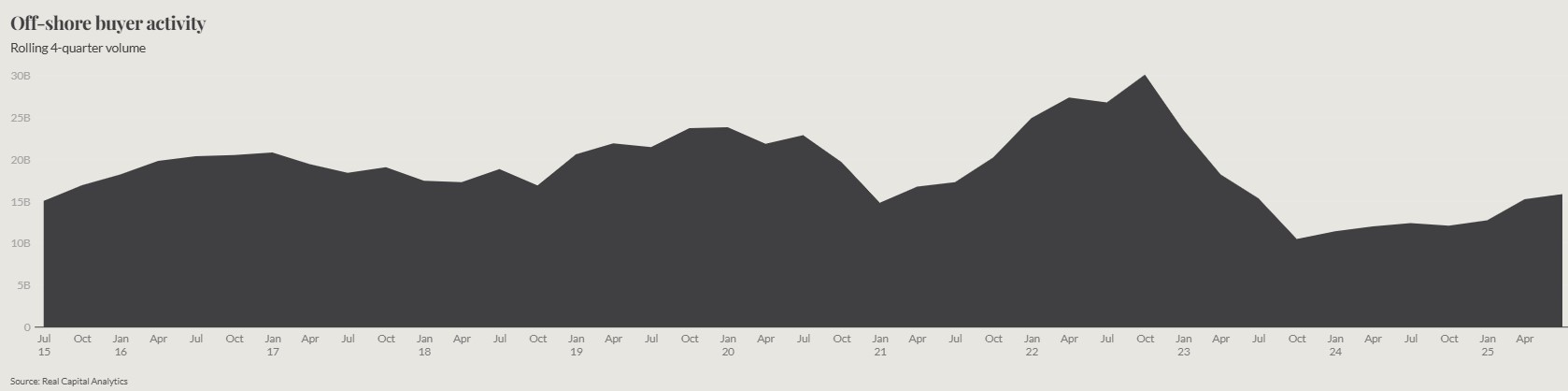

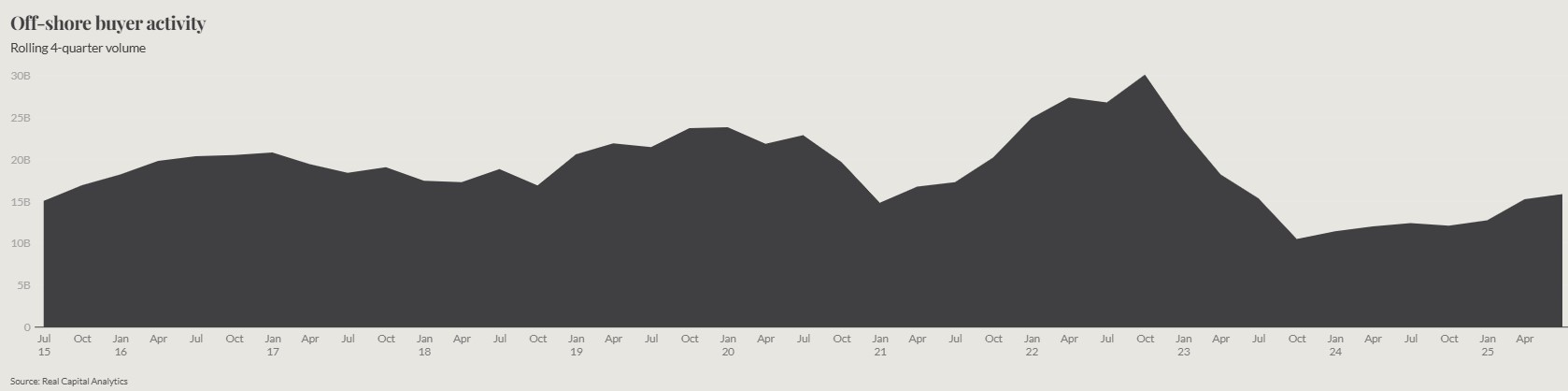

There’s a dramatic turnaround happening in Australia’s commercial property investment landscape. Foreign capital is flooding back in, approximately $15.9 billion year-to-date through Q2 2025, which is a big jump from the $10 billion for all of 2023.

Why the comeback?

FIRB (the Foreign Investment Review Board) processing times have improved significantly, with median processing now taking 29-34 days for commercial proposals. This regulatory efficiency has created a more competitive environment for attracting international capital, with Australia’s framework now balancing appropriate oversight while recognising that delayed approvals deter investment in an increasingly competitive global market.

What are they buying?

According to FIRB, the composition of foreign investment reveals strategic shifts toward next-generation commercial assets. Commercial real estate attracted $10.0 billion in approved foreign investment through the 2024 calendar year, with international investors increasingly targeting specialised assets that benefit from structural economic changes like:

- Data centres

- Cold storage facilities

- Advanced logistics infrastructure

Who’s investing?

American investors continue to dominate both the approval pipeline and transaction activity, maintaining their position as the largest source of cross-border capital with $6.9 billion in flows year-to-date through mid-2025 which is expected to balloon to over $9 billion by the conclusion of 3Q 2025. This sustained interest reflects the structural appeal of Australian commercial property to US institutional investors and the continued currency advantage making Australian assets attractive on a USD basis.

Japanese capital has returned with renewed vigour, contributing $2.5 billion in cross-border transactions through mid-2025. This represents Japan’s re-emergence as a major player in Australian commercial property, with particular interest in office and industrial assets where long-term lease structures align with Japanese institutional investment preferences.

Korean institutional investors have emerged as significant new players, showing particular interest in build-to-rent developments and student accommodation projects in major metropolitan areas. This influx arrives at a crucial time when purpose-built rental housing is needed to address supply constraints, demonstrating how foreign investment increasingly targets assets serving structural market needs.

Singapore’s investment flows have shown steady growth, reaching nearly $1.2 billion year-to-date through 2025, while maintaining consistent activity across commercial real estate and specialised industrial sectors. Hong Kong capital is likely to contribute to over $1 billion by the end of 3Q 2025, with continued interest in prime office assets despite global economic uncertainties.

The emergence of Thailand as a significant new player representing one of the most striking developments in current foreign investment patterns. Thai investors are focusing primarily on commercial real estate, suggesting strategic diversification of investment sources now targeting Australian commercial property.

Why this matters

The breadth of asset classes now attracting foreign investment demonstrates how international investors view Australia as offering diversified exposure to structural growth trends. FIRB approval patterns show this diversification accelerating through 2024, while transaction data confirms capital flows are following approved investment strategies.

Alternative residential asset classes have become particularly important in attracting foreign capital. Purpose-built student accommodation and build-to-rent developments are drawing significant international interest, addressing critical supply gaps while providing investors with income-generating assets aligned to demographic trends.

The bigger picture

This multi-sector, multi-source approach creates greater stability for Australian commercial property investment volumes and reduced reliance on any single asset class or capital source. The data reveals not just a cyclical recovery but potentially a structural shift toward higher baseline levels of foreign investment across an expanded range of commercial property sectors.

The combination of improved regulatory efficiency, diverse capital sources, and evolving asset class preferences positions Australia’s commercial property market to capture a larger share of global institutional investment flows, with foreign investors increasingly viewing the market as offering both defensive characteristics and exposure to structural growth opportunities.

______________________________________

Vanessa Rader – Ray White Head of Research