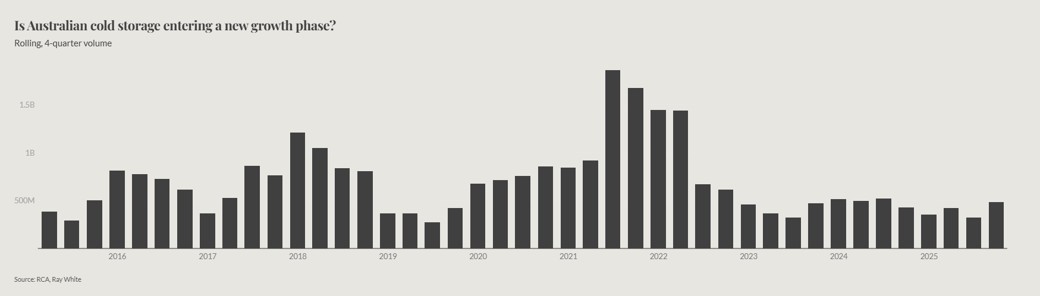

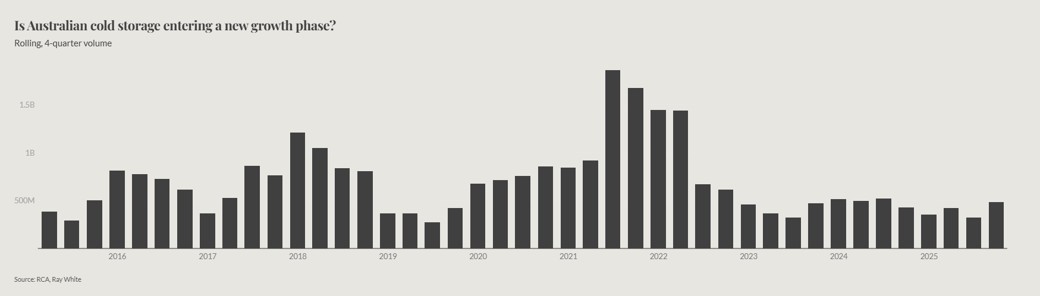

Australia’s cold storage sector is experiencing a pronounced acceleration in both investment activity and development sophistication as the asset class matures beyond its traditional origins as owner occupiers. Transaction volumes surged 156 per cent compared with the same quarter last year in the third quarter of 2025, reaching $259.6 million, combined with the previous three quarters, the rolling 12 month volume total now stands at $480.2 million, up 11.9 per cent on the prior period. This momentum signals not merely a recovery from subdued 2023 and 2024 levels, but a fundamental re-rating of the sector’s investment credentials among institutional and cross border capital.

The sector’s evolution is evident not only in transaction metrics but in the increasing complexity of development approaches being deployed across the country. As demand from both traditional food and beverage users and expanding pharmaceutical and health science applications continues to outpace existing supply, developers and investors are grappling with how to deliver specialised assets faster while maintaining the exacting standards these facilities require.

Unlike conventional industrial warehousing, refrigerated facilities require specialised knowledge and careful planning at the early stages. Cold storage facilities consume substantially more power than standard warehouses, requiring robust electrical infrastructure often necessitating substation upgrades or new connections. Sites that appear attractive for conventional industrial use may prove unviable for refrigerated development due to power constraints, making due diligence around utilities increasingly critical in the site selection process.

Melbourne has capitalised on both land availability and infrastructure capacity to dominate new supply, with investment volumes so far in 2025 reaching $260 million. Victoria’s metropolitan and regional markets are currently hosting the lion’s share of the 110,000 sqm currently under construction across Australia, followed by Brisbane and Sydney where land scarcity and higher entry costs create additional development hurdles.

The tension between rapid delivery and enduring quality represents one of the sector’s defining challenges. With vacancy rates compressed and user demand robust, the temptation to pursue speed over optimisation can be compelling. However, cold storage assets are plays for the long duration where operational efficiency directly impacts tenant retention and rental sustainability. Retrofit strategies, including the box in box concept where refrigerated space is created within existing structures, can dramatically reduce delivery timeframes versus construction from the ground up, offering a pathway to capture demand faster in markets constrained by supply.

For development from the ground up, the decision between speculative approaches and building to suit carries significant implications. Speculative development of cold storage requires substantial confidence given the higher construction costs and specialised nature of the product. The market has witnessed varying outcomes, with some speculative projects securing tenants ahead of completion whileothers have faced extended periods to lease up. The key differentiators appear to be location, specification flexibility, and realistic rent expectations relative to comparable alternatives built to suit.

Investment flows and market dynamics

The investment landscape has shifted markedly, with buyers from offshore now representing nearly 80 per cent of acquisition activity so far this year. Canadian pension funds have been particularly active, with PSP Investments’ acquisition of a portfolio including three Melbourne assets exemplifying the scale of institutional interest. North American capital, drawing from extensive cold storage experience in their home markets, recognises the structural drivers underpinning Australian demand: population growth, fresh food consumption patterns, and pharmaceutical supply chain requirements.

This buying pressure from offshore has contributed to yield compression, with cap rates in 2025 transactions settling within a narrow band of 5.2 to 6.6 per cent. The pricing discipline reflects investor confidence in the durability of cold storage fundamentals. Domestic institutional investors and REITs remain active, but increasingly find themselves competing against offshore players with strong capital positions who are comfortable with lower return hurdles. The net result is a market where owner occupiers have become consistent net sellers, monetising holdings into a liquid investment market that barely existed a decade ago.

The integration of automation and technology is reshaping facility design and tenant requirements. Modern cold storage developments increasingly incorporate automated storage and retrieval systems, particularly in pharmaceutical and health science applications. These systems require significant upfront capital but deliver substantial operational efficiencies over the asset’s life. The challenge for speculative developers lies in anticipating which automation solutions will have broad tenant appeal versus niche applications, as overbuilding infrastructure risks pricing the asset beyond what many potential tenants can justify.

Australia’s cold storage sector stands at an inflection point where construction innovation, investment appetite, and user demand are converging. The technical complexity that once limited the sector’s investment appeal now acts as a barrier to entry, protecting returns for those with the expertise to deliver and operate these assets effectively. The challenge for market participants is navigating the trade offs inherent in cold storage development: balancing speed against optimisation, speculation against certainty, and automation against flexibility.

As the sector continues to attract institutional capital and mature in its development sophistication, those who can successfully marry construction excellence with investment discipline will be best positioned to capitalise on the structural growth drivers that underpin this specialised corner of the industrial market. With over 110,000 sqm under construction and strong transaction momentum maintained into late 2025, the sector’s trajectory remains firmly expansionary.

______________________________________

Vanessa Rader – Ray White Head of Research