The Australian commercial property market saw a significant resurgence in foreign investment through 2024, particularly evident in the final quarter, helping drive total preliminary analysis of transaction volumes to $76.64 billion – a 19.2 percent increase on 2023 results. This renewed offshore interest, combined with steady domestic investment, signals growing confidence in Australian commercial real estate despite broader economic challenges.

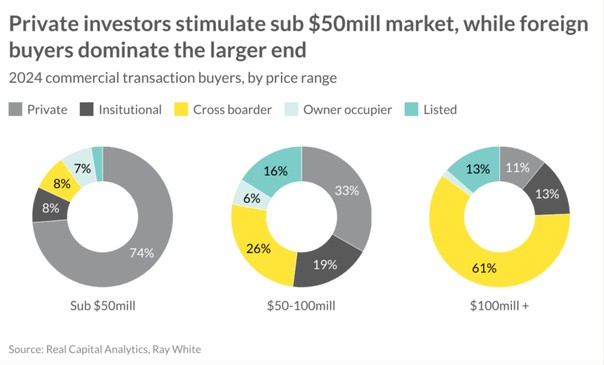

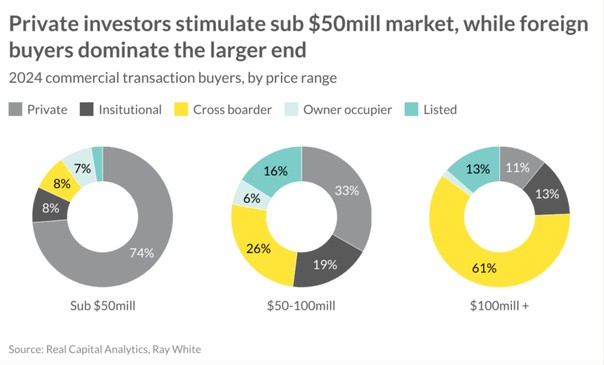

The market demonstrated clear segmentation across price points, with domestic private investors dominating the sub-$50 million segment, accounting for approximately three-quarters of transactions. These acquisitions were predominantly focused on industrial assets across NSW and Victoria, with private investors particularly active in last-mile logistics facilities and smaller industrial units that offer strong tenant covenants.

The mid-market segment ($50-100 million) witnessed increased offshore buyer activity as international investors sought to capitalize on favorable currency conditions. This price point saw a balanced distribution across sectors, with retail leading transaction volumes, followed by similar levels of investment across office, industrial, and development sites. NSW remained the preferred investment destination, followed by Victoria and Queensland, reflecting the continued focus on core markets with strong population growth and infrastructure investment.

Most notably, the institutional segment (over $100 million) experienced substantial momentum in the final quarter of 2024, reaching $30.43 billion in total transactions, with Sydney accounting for more than $22 billion. Foreign investors emerged as dominant players in this segment, representing over 60 percent of purchases while accounting for 51.2 percent of sales, resulting in significant net acquisitions by offshore capital.

The industrial sector, particularly data centres, attracted the strongest interest at this price point, though prime office and retail assets also recorded notable transactions. This surge in foreign investment reflects several key factors: Australia’s strong economic fundamentals, minimal currency hedging requirements in the current market, and the relative value proposition created by a favorable USD/AUD exchange rate, particularly for institutional-grade assets. The trend toward specialized industrial assets, including cold storage facilities and data centres, highlights the evolution of foreign investment strategies, with buyers increasingly focused on sectors benefiting from structural changes in the economy.

United States investors dominated acquisition activity in 2024, leveraging their currency advantage to diversify portfolios while seeking stable, transparent markets. Japanese capital continued to strengthen its presence in Australian property markets, followed by steady investment flows from Singapore, Hong Kong, and Canada. These investors showed particular interest in the office sector, attracted by the correction in capitalisation rates and potential for value-add opportunities in prime assets, while also maintaining a strong appetite for industrial and retail investments that align with their long-term investment strategies.

Early 2025 has already witnessed an expanding pool of international capital, with notable diversification in both investor origins and target sectors. Korean institutional investors have emerged as significant new players, particularly attracted to build-to-rent and student accommodation developments in major metropolitan markets. This surge in residential development funding comes at a crucial time, with these purpose-built rental projects positioned to help address Australia’s housing supply challenges.

Looking ahead, this broadening of both capital sources and investment strategies suggests a maturing market that continues to attract global investment. While traditional commercial sectors remain important, the growth in alternative residential development funding highlights the evolution of Australia’s appeal to international investors. The combination of Australia’s transparent market conditions, robust regulatory framework, and strategic position in the Asia-Pacific region suggests sustained offshore interest through 2025, particularly as new investors seek to establish long-term positions in the market.

_____________________

Vanessa Rader | Ray White Head of Research