After a period of significant market correction and uncertainty, commercial real estate investors are faced with a compelling question: Is now the time to step back into the market? Several key indicators suggest we may be approaching an opportune moment for strategic acquisitions across multiple asset classes.

The property clock shows many commercial sectors sitting in the trough phase of their respective cycles. This positioning traditionally signals a prime entry point for investors with longer-term horizons. While some may view current market conditions with apprehension, history shows that fortune often favours those who can recognize opportunity amid uncertainty.

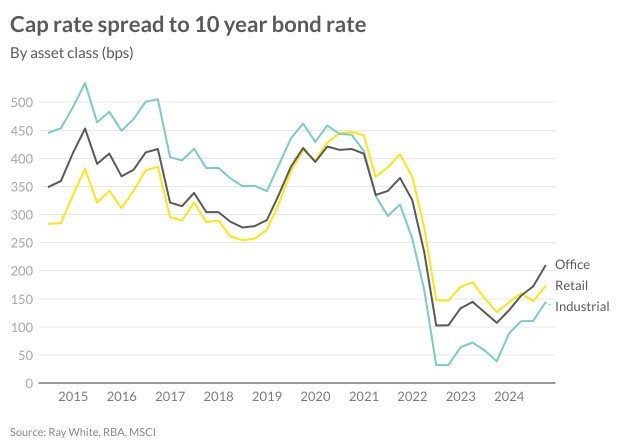

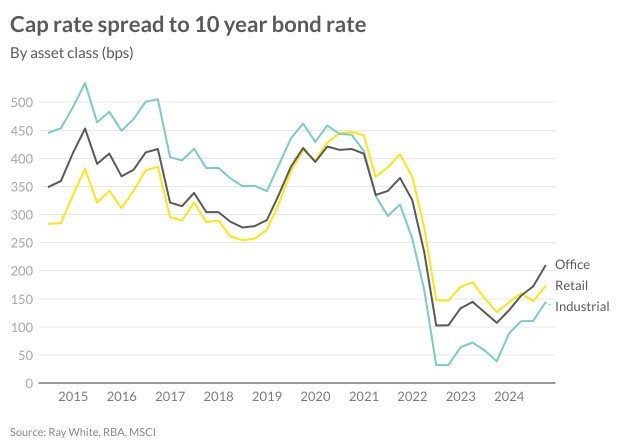

A particularly compelling indicator is the widening spread between capitalisation rates and government bond yields across all asset classes. This expanding spread suggests improved relative value compared to risk-free rates, providing investors with an attractive risk premium that has been expanding since late 2023. This trend stands in stark contrast to the compressed spreads seen during the peak of the market.

Each sector presents its own unique dynamics. Industrial property, despite moderating from its pandemic-driven highs, continues to demonstrate resilient fundamentals driven by e-commerce and owner occupier demand. The office sector, while facing structural challenges from hybrid work patterns, offers selective opportunities in premium, well-located assets that meet evolving tenant demands for quality space and amenities. Retail is experiencing a revival in certain submarkets, particularly in neighbourhood centres that have successfully adapted to changing consumer behaviours.

Alternative assets are emerging as increasingly attractive opportunities. Data centres and healthcare facilities, are benefiting from secular growth trends, while block of units, student accommodation and self-storage facilities are demonstrating strong defensive characteristics in the current market.

Capitalisation rates have expanded significantly across most asset classes, reaching levels not seen in recent years. These higher cap rates are creating attractive entry points, particularly when compared to the compressed yields of 2021-2022. While current returns may appear subdued, they’re showing signs of stabilisation – a crucial indicator that we may be approaching the bottom of the market cycle.

The risk-reward equation is increasingly tilting in favour of investors. Current pricing reflects many of the market’s concerns: higher interest rates, banking sector challenges, and economic uncertainty. This market correction has effectively priced in much of the downside risk, creating a cushion for new investments. While further modest adjustments are possible, the dramatic repricing we’ve witnessed over the past 18-24 months appears to be largely behind us.

Looking ahead to 2025, the interest rate environment is expected to improve as central banks pivot towards more accommodative monetary policy. This anticipated shift could provide a significant tailwind for commercial property values, particularly for investors who secure assets at today’s prices with the ability to refinance at potentially lower rates in the future.

Furthermore, the current market presents opportunities for selective buyers to secure quality assets at attractive prices. Many properties that would have been out of reach during the market peak are now available at more reasonable valuations. Those who can identify assets with strong underlying fundamentals and clear value-add potential may find themselves well-positioned as the market cycles back into its recovery phase.

For investors with patient capital and a long-term perspective, current market conditions may present an opportunity that we’ll look back on as an optimal entry point. While uncertainty remains, the fundamentals increasingly suggest that now may indeed be the time to selectively re-enter the commercial property market.

_____________________

Vanessa Rader | Ray White Head of Research