Retail properties have seen a revival this year, with transaction volumes rising as confidence grows, particularly among private investors. Nationwide population growth and limited new development have reduced the average GLAR (gross lettable area retail) per person, renewing interest in this asset class. Notably, properties offering convenience, supermarket and food options, or those with potential for future development are attracting attention.

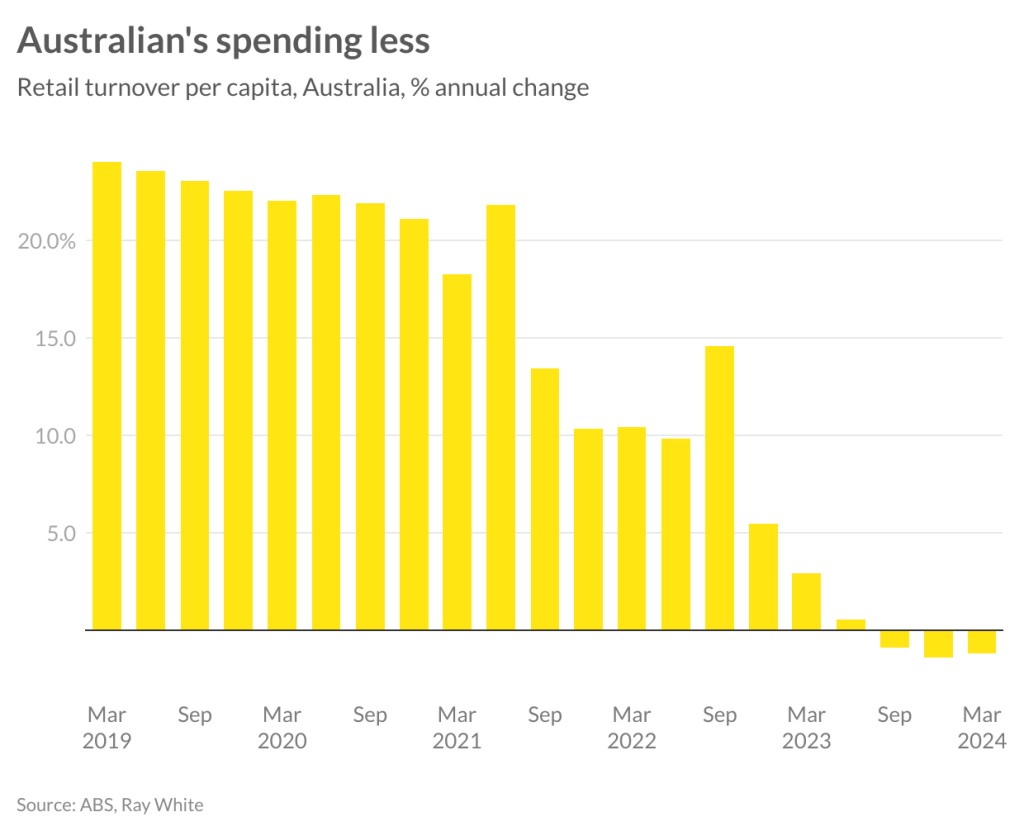

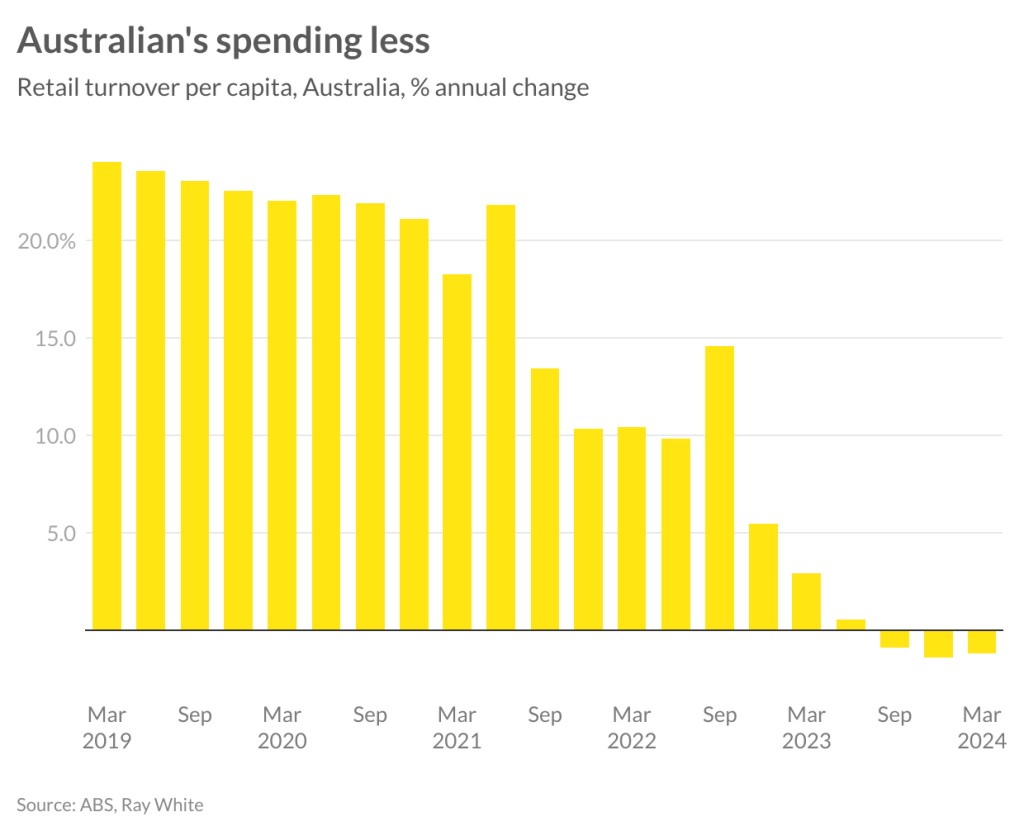

While overall retail turnover continues to climb due to inflation, Australians are becoming more cautious with their spending in response to rising interest rates and housing costs. Despite the decrease in retail space per capita, consumer spending has also declined on this basis. During the pandemic, when financing was inexpensive, Australians increased their annual spending by over 20 per cent. However, this trend reversed sharply as interest rates began to rise in 2022. Currently, the ongoing threat of interest rate hikes and high housing costs has resulted in per capita retail turnover reaching $3,954 in the first quarter, a 1.2 per cent year-on-year decrease, significantly lower than the peak of $4,000 recorded in 2022.

However, overall retail trade has actually grown, thanks to population increases. May saw a 0.6 per cent monthly rise, or 1.7 per cent annually, with Western Australians leading the spending charge, up 1.3 per cent for the month. In contrast, New South Wales and South Australian consumers have reined in their spending, with a 0.1 per cent decrease this month.

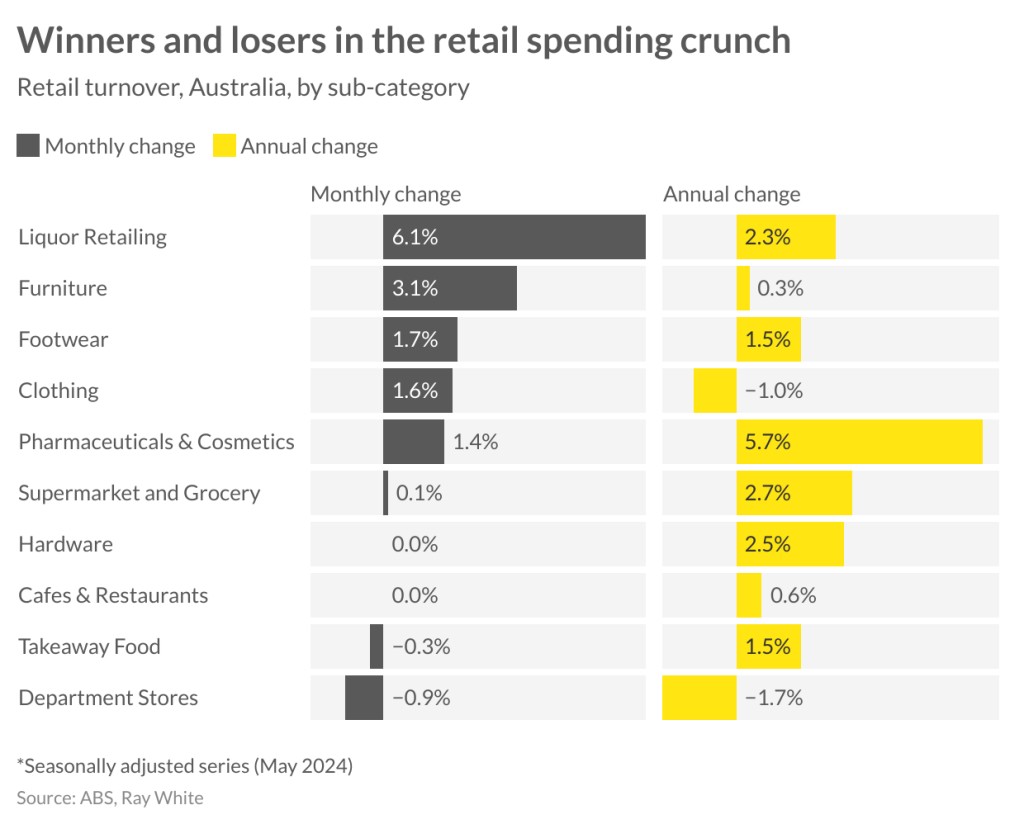

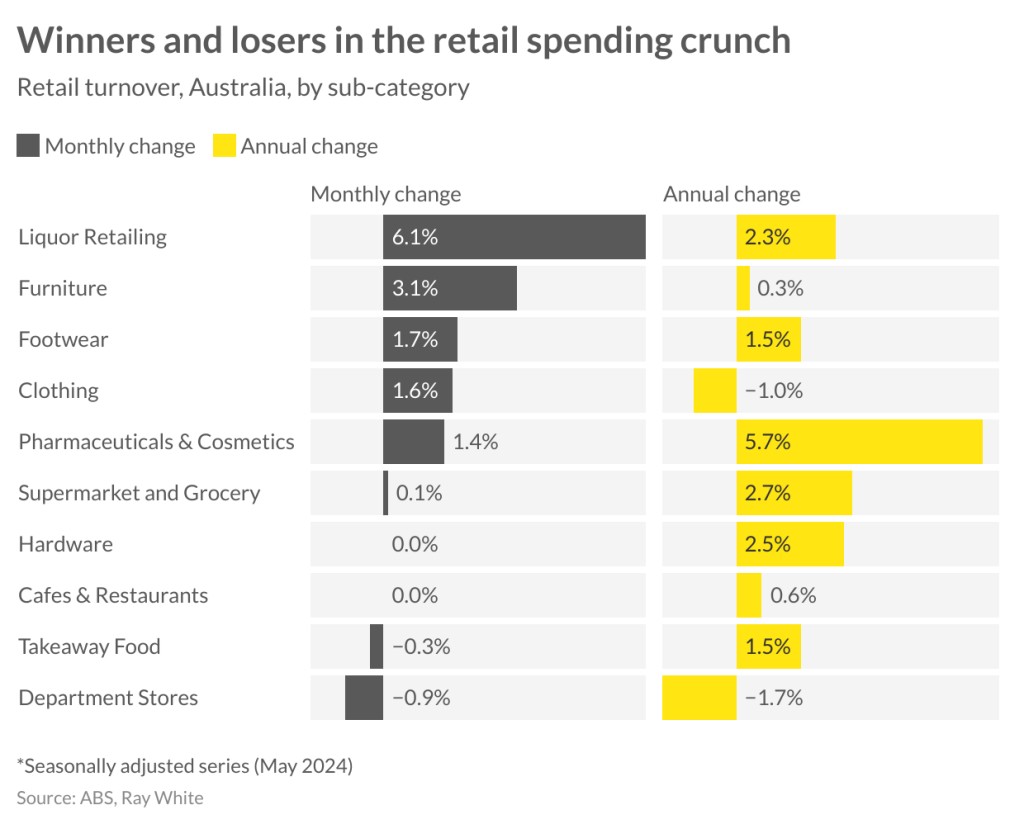

The breakdown of our spending habits is particularly revealing. Last month, liquor retailing saw the biggest surge, growing 6.1 per cent over the month and 2.3 per cent year-on-year. Despite rising housing costs, new homeowners are investing in furniture, resulting in a 3.1 per cent increase this month, with consistent growth across all states. Large format retail is likely to continue benefiting from this trend. Meanwhile, standalone liquor stores, especially those with secure leases to brands like Dan Murphy’s, BWS, and Liquorland, are expected to maintain tight yields.

Surprisingly, the clothing and soft goods sector saw continued growth this month. While annual figures remain down, footwear demand persists, making it an attractive retail mix for small neighbourhood or sub-regional centres. The pharmaceutical and cosmetics sector has shown growth over the past year, despite reduced discretionary spending. Low-cost indulgence items remain popular, with brands like Chemist Warehouse now rivalling supermarket sales. In pursuit of savings, consumers are more price-conscious and no longer view supermarkets as the sole low-cost option for consumables. Discount chemists, offering medications, vitamins, beauty products, and personal care items, have played a key role in keeping supermarket retail figures down. Additionally, ‘big box’ stores like Bunnings now stock pet food and cleaning supplies, traditionally supermarket domains. These standalone retail offerings, with expanding services, continue to attract investors, maintaining competitive yields. While this doesn’t spell the end for supermarkets, it reflects changing consumer behaviour during high inflation, benefiting retail owners who can adapt.

In recent years, food retailing has bolstered strip retail and small centres in maintaining high occupancy. However, this trend is shifting. Belt-tightening has led to stagnant restaurant and café spending this month, with only a 0.6 percent annual increase, potentially pressuring these retail shops. Fast food, previously benefiting from reduced spending, has also declined, down 0.3 percent this month and up just 1.5 percent annually. Department store activity continues its year-on-year decline, resulting in fewer stores nationwide. However, the quest for cost-effective items has driven consumers towards discount department stores like Kmart, making sub-regional (or larger) centres attractive to property investors.

Vanessa Rader | Head of Research