The Property Council of Australia’s latest bi-annual office market report reveals ongoing challenges in the sector, with vacancy rates continuing to rise across most markets. However, prime locations continue to outperform secondary markets. An analysis of changes in occupied stock highlights clear leaders among office markets in this post-pandemic era.

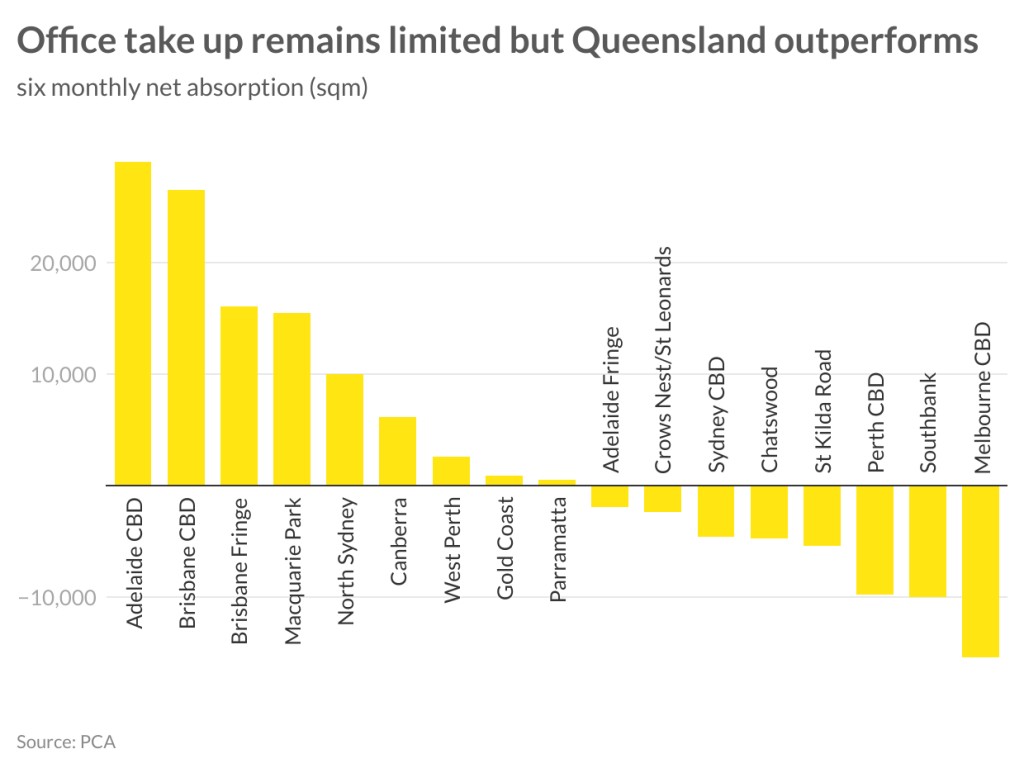

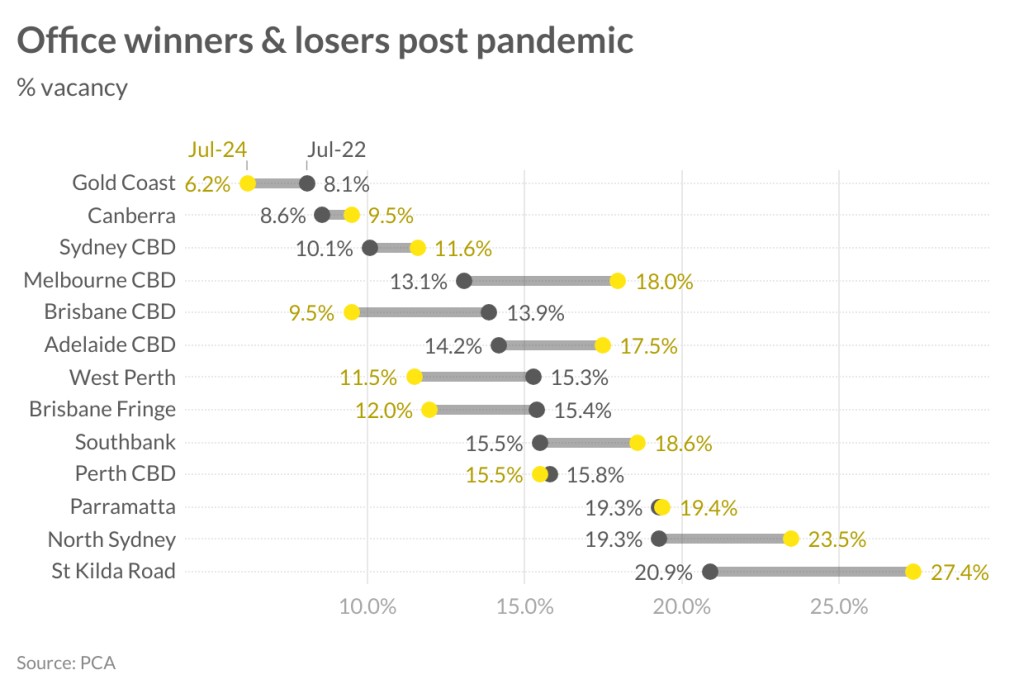

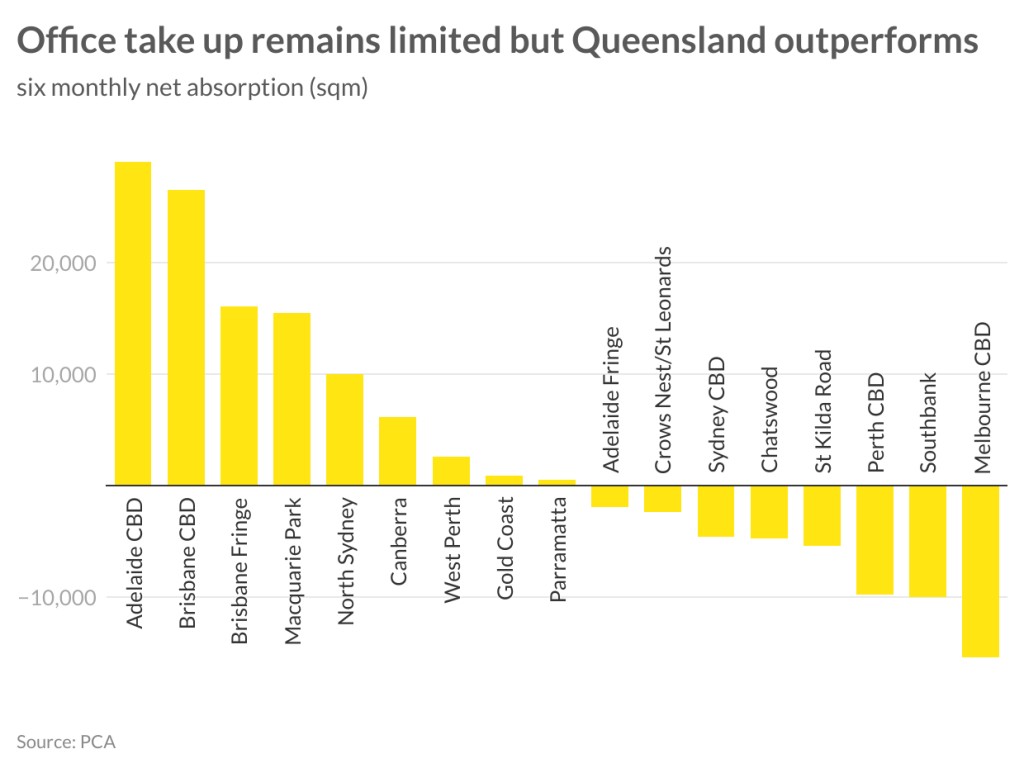

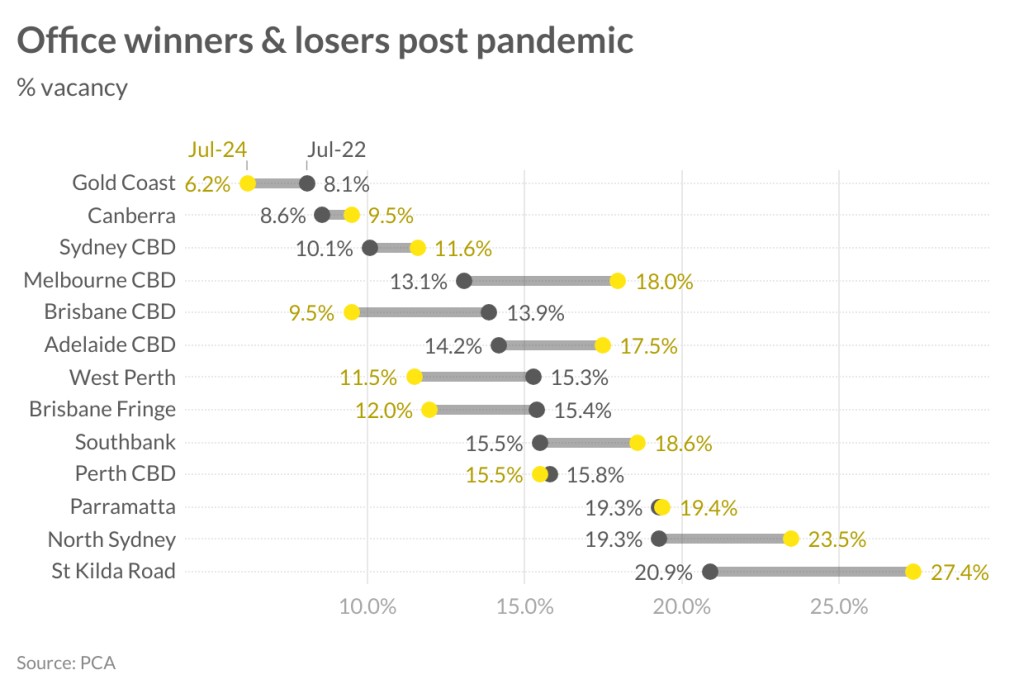

Adelaide CBD tops the list for net absorption this year, however, largely due to pre-commitments for new supply. The market’s vacancy rate decreased from 19.5 per cent to 17.5 per cent over the past six months. Post-Covid, Adelaide has experienced significant volatility, impacted by continuous additions of new and refurbished stock.

Queensland emerges as the standout performer in the office sector, particularly the Brisbane fringe market. Brisbane CBD shows promising results with net absorption of 26,552 sqm, while net supply decreased by 27,245 sqm, reducing vacancy to 9.5 per cent. The Brisbane fringe market continues its upward trajectory, recording its seventh consecutive period of positive take-up at 16,065 sqm in July 2024, bringing vacancies down to 12 per cent. Despite limited available stock, Gold Coast absorbed an additional 906sqm in the first half of 2024. These strong results across Queensland indicate ongoing business growth and a shift away from remote work trends.

Perth’s office market also shows promise, with West Perth absorbing 2,553sqm and consolidating vacancies to 11.5 per cent. However, Perth CBD continues to face challenges, with vacancies rising to 15.5 per cent from 14.9 per cent in January 2024 despite the PCA’s boundary revision.

The office market’s recovery since the pandemic has been slow, with Queensland and Perth markets showing declining vacancy rates, indicating a return to “business as usual” compared to larger markets like Sydney and Melbourne. Melbourne CBD continues to struggle, with vacancy rates increasing for the ninth consecutive period to 18 per cent, now representing 943,775sqm of available stock.

Sydney CBD experienced some vacancy compression over the last six months, currently at 11.6 per cent, thanks to increased withdrawals despite negative take-up. Vacancies in Sydney CBD reached a low of 3.7 per cent in July 2019 but grew to 10.1 per cent by July 2022 before continuing to rise. Sydney’s non-CBD markets have seen greater vacancy growth post-pandemic, with North Sydney, Crows Nest/St Leonards, and Chatswood all exceeding 20 per cent vacancy rates this period. Parramatta, while affected by a flight to quality, has maintained stable but high vacancies at 19.4 per cent due to stock withdrawals.

The Australian office market landscape presents a varied picture, with Queensland emerging as the clear frontrunner in performance. While challenges persist across all markets, particularly in Sydney and Melbourne, the resilience and growth seen in Queensland’s office markets – notably Brisbane CBD, Brisbane Fringe, and Gold Coast – highlight a shift towards regional strength and adaptability. Adelaide’s improvement and Perth’s mixed results further underscore the uneven nature of the post-pandemic recovery. As businesses continue to navigate the evolving work environment, the disparity between prime and secondary markets remains evident, suggesting a continued flight to quality. Moving forward, the office sector’s recovery will likely remain gradual and geographically diverse as we manoeuvre business demands and working patterns.

Vanessa Rader | Head of Research