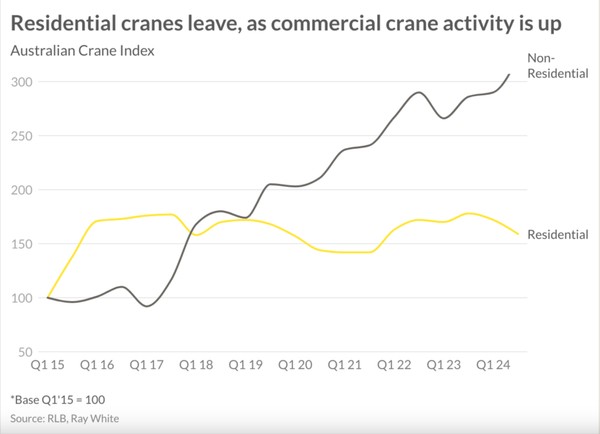

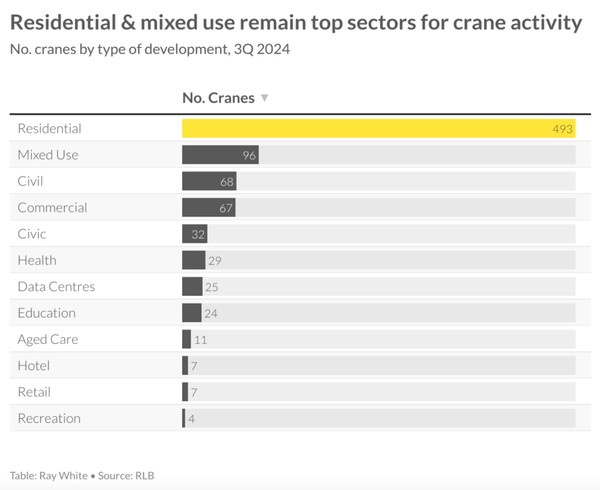

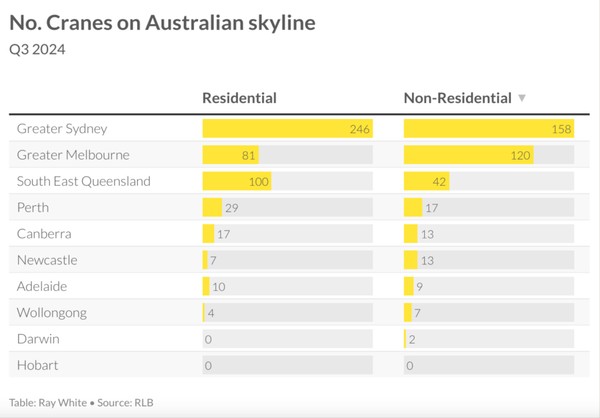

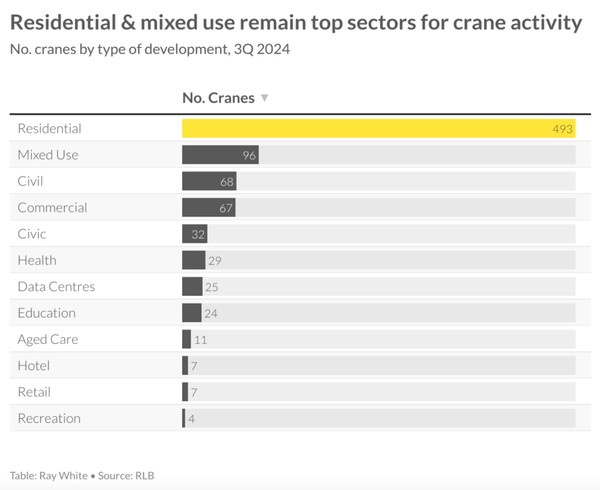

The RLB bi-annual crane count for Q3 provides an insight into construction activity across Australia, revealing significant shifts in development patterns. At the national level, a notable trend has emerged: a decline in residential development activity contrasted with growth in non-residential sectors. The number of residential cranes dotting the skylines across the country has decreased from 535 to 493 over the past six months, resulting in a substantial fall in the index result.

Conversely, the non-residential sector has demonstrated robust growth, with an increase of 34 cranes over the same period, bringing the total to 370. This surge has propelled the index to its highest rate on record since its inception in 2015, indicating a strong focus on commercial development and changing urban development priorities.

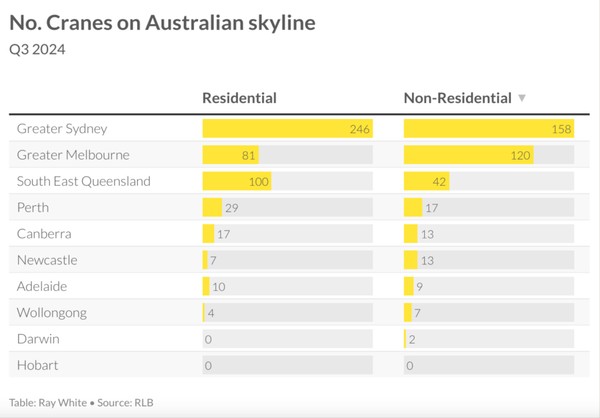

Looking regionally, south east Queensland has recorded net losses in crane numbers, most notably as 34 residential projects reach completion, replaced by only 30 new ones. This trend is particularly evident in Brisbane and the Sunshine Coast, which have both seen reductions in crane numbers. However, the Gold Coast bucks this trend, continuing to see an uplift in crane numbers. Despite the overall decline, residential projects still dominate the south east Queensland skyline, accounting for 100 cranes (albeit down from 104), while non-residential cranes maintain a significant presence.

Sydney retains its position as the epicentre of construction activity in Australia. Sydney’s western region has shown the most significant growth, now home to 108 cranes, up from 95 six months ago. Greater Sydney hosts an impressive 246 cranes for residential projects, though it’s worth noting that this represents a negative net movement. This decline highlights that project completions are outpacing new construction starts, however, non-residential cranes have seen positive net movements across various sectors, including mixed-use, education, civic, civil, and even commercial.

Melbourne has experienced some of the most dramatic changes over the past six months. The number of residential cranes has plummeted from 107 to 81, in contrast, non-residential projects have become the key area of construction activity for this market. There’s a strong focus on infrastructure, with cranes for civil, civic, and data centre projects all continuing to grow.

Other major cities, including Perth, Adelaide, and Canberra, have seen limited changes in their crane counts. However, there have been slight improvements across both residential and non-residential construction sectors, indicating steady growth in these markets.

The overall national trend shows a decline in residential crane counts, while the non-residential sector has seen an uptick. Mixed-use developments continue to be the second most active sector after residential. This trend is fueled by the ongoing need for residential dwellings and the growing popularity of mixed-use projects that cater to both residential and commercial needs, often combining residential spaces with retail, office, or hotel facilities.

Interestingly, the sector that has seen the greatest increase in cranes over the last six months is civil construction, up by 11 cranes. This growth reflects strong investment in infrastructure across the country, notably in Brisbane (the future Olympic city), followed by Melbourne and Sydney. The increase in civil projects suggests a focus on improving urban infrastructure given our positive population story.

Other sectors showing growth in crane numbers include civic, commercial, and data centres, highlighting the changing face of projects across Australia. However, some sectors have shown limited growth despite apparent demand. The development sectors of aged care and education have seen minimal positive change in crane numbers, which is somewhat discouraging given Australia’s ageing and growing population. This trend may suggest a need for increased focus on these vital social infrastructure sectors in the future.

Two commercial asset classes that have grown in investment popularity in recent times are retail and hotel. Interestingly, there appears to be limited new supply projects for these sectors, which is likely to continue fueling their demand. This scarcity of new developments in retail and hospitality could present opportunities for investors and developers in the coming years.

____________________________

Vanessa Rader | Head of Research